PREFACE

The United Arab Emirates is one the most robust economy among GCC member countries has been successfully diversifying its economy from the oil sector to the non-oil sector. But still heavily reliant on revenues from petroleum and natural gas. The UAE government has targeted towards reducing the economy’s dependence on oil exports by 2030. Tourism is a more significant source of non-oil income in the UAE. Dubai is the transhipment hub in the middle east and caters to this region efficiently as it holds state-of-art supply chain infrastructure.

The United Arab Emirates is having 12 seaports and nine airports. The major seaports are Jebel Ali and Mina Rashid in Dubai, Mina Zayed, Abu Dhabi and Mina Khalid and Khor Fakkan in Sharjah, well-integrated with free zones for ease doing business. By the year 2027, GCC will get ready with rail systems to transport passengers and goods across the GCC region. Rail infrastructure will further boost UAE as well as GCC economy.

The country has robust mechanism and infrastructure for movement of goods smoothly from international borders as well as within the state. The UAE government enacted the law in 2020 to allow to set up 100% ownership category of companies in the mainland area for manufacturing and services sector, which will boost the economy. There are customs duty drawback incentives available for specific manufacturing industries.

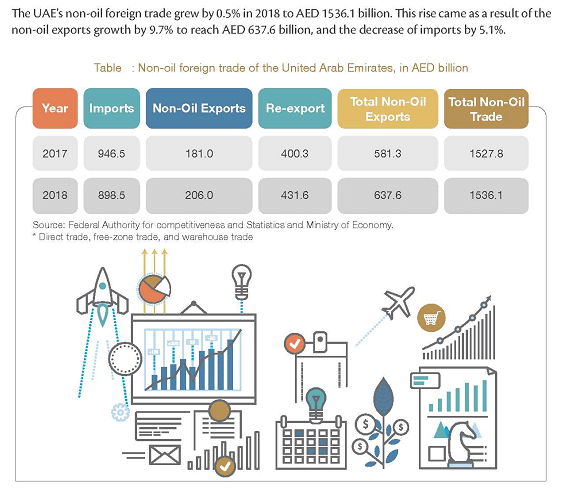

UAE Non-oil Foreign Trade Chart

Customs duty exemption and VAT benefits

The United Arab Emirates allows companies to do import and export business from mainland area as well as free zone areas. Customs duty suspension is a procedure by which Customs duty will not be levied on certain imports. These goods which are under the customs duty suspension will also not attract import VAT.

The supplies which come under customs duty suspension are:

- Goods entering UAE under the temporary regime

- Goods which are placed in a customs bonded warehouse

- Goods entering UAE in transit

- Goods imported which are intended to be re-exported by the same person who imported them

If the above procedures fail to comply, the said goods treated as goods imported into UAE will attract 5% customs duty, 50% on Alcohol and 100% on cigarettes. And subject to value-added tax as per VAT provisions.

Designated Free Zone Benefits

The country classified free zones into designated and non-designated free zones. Designated free zones enjoy value-added tax and customs duty exemption benefits for certain transactions when compare to other free zones. There is no customs duty and value-added tax for goods sold within the designated free zones and outside UAE. The all other re-exports from all free zone companies as well as mainland companies also exempted from customs duty and value-added tax.

Transportation

The UAE has state-of-art facilities to cater to import and exports businesses. Majority of seaports and airports well connected and integrated with UAE designated free zones well equipped with logistics terminals and storage facilities. World’s major logistics giant players present and set up their facilities and resources to cater across the globe. All free zones well connected by roads within the country and nearby Oman as well as Saudi Arabia.

List of Designated Free Zones to know

Here is the complete list of Designated Zones as per the Annex to the Cabinet Decision No (59) of 2017.

Abu Dhabi

- Free Trade Zone of Khalifa Port

- Abu Dhabi Airport Free Zone

- Khalifa Industrial Zone

Dubai

- Jebel Ali Free Zone (North-South)

- Dubai Cars and Automotive Zone (DUCAMZ)

- Dubai Textile City

- Free Zone Area in Al Quoz

- Free Zone Area in Al Qusais

- Dubai Aviation City

- Dubai Airport Free Zone

Sharjah

- Hamriyah Free Zone

- Sharjah Airport International Free Zone

Ajman

- Ajman Free Zone

No. Designated Zones (Umm Al Quwain)

- Umm Al Quwain Free Trade Zone in Ahmed Bin Rashid Port

- Umm Al Quwain Free Trade Zone on Shaikh Mohammad Bin Zayed Road

Ras Al Khaimah

- RAK Free Trade Zone

- RAK Maritime City Free Zone

- RAK Airport Free Zone

Fujairah

- Fujairah Free Zone

- FOIZ (Fujairah Oil Industry Zone)

Selling goods from Free Zone into the mainland area

The free zone companies not allowed to import directly into mainland area but allows to import by appointing the distributor or by way of the buyer and sell agreement or having your license arrangement to move goods regularly from free zone area to mainland area.

There are certain product approvals and registration required from the local municipality, concern ministries, departments, and trademark registration requirements, wherever applicable by the concern people or companies AI. For example, importing of medical equipment’s and devices into UAE, storage and sell locally require registration of products from the Ministry of Health and approval from the Ministry of health and prevention. This procedure will not apply for transit goods and supplies which come under customs duty suspension.

VAT treatment benefits for Designated Free Zones

Table of treatment for designated free zones:

| FROM | TO | VAT Treatment |

| Designated Free Zones | Designated Free Zones | Out of scope of VAT |

| Designated Free Zones | Foreign Countries/GCC countries | Out of scope of VAT |

| Foreign Countries/GCC countries | Designated Free Zones | Out of scope of VAT |

| Designated Free Zones | Mainland Area | 5% vat on reverse charge mechanism basis |

| Mainland Area | Designated Free Zones | 5% standard rate VAT |

The blog is written by Senior Consultant from www.alfamc.com

[addtoany]